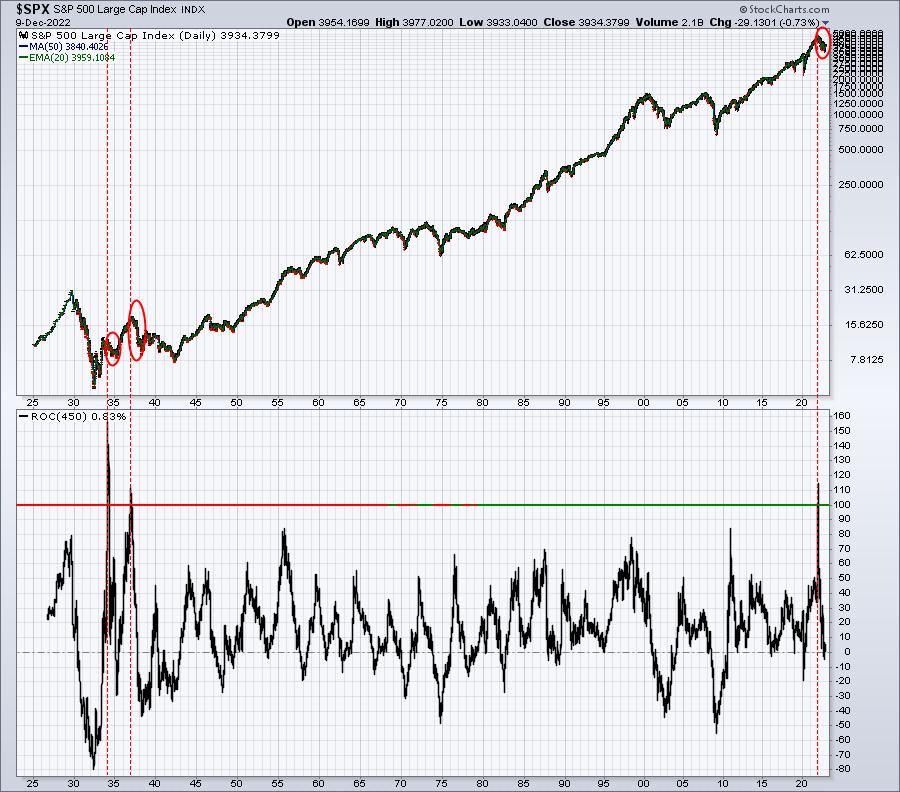

At our MarketVision 2022 event on Saturday, January 8, 2022, I said stock market bulls would need patience—a lot of it—because it was going to take some time for sentiment, which was ridiculously bullish, to reset. I also said at the time that we should expect a minimum of three to six months of cyclical bear market action to unwind the frothy conditions that resulted from the largest 22-month gain since the 1930s. Below is a chart of the S&P 500 Index ($SPX) that dates back 100 years. It’s a daily chart that includes a bottom panel, highlighting the 450-day rate of change (ROC)—450 trading days is approximately the equivalent of 22 months. Check this out:

Sometimes calling the stock market direction is just plain common sense. The 22-month gain that we saw at the end of 2021 was topped only during the 1930s (vertical red-dotted lines) as the stock market tried to rebound from The Great Depression. These types of (nearly) two-year rallies only occur after a massive decline. The ensuing drop in the next year is quite predictable (red circles above). Since 1950, $SPX has averaged gaining 9% per year. So a normal gain over two years would be roughly 18%. A 115% gain in two years is simply unsustainable.

Those who believed that the stock market would just keep flying higher in 2022 were ignoring history and reality. It just doesn’t happen. Calling a top is never easy, but understanding the risks of remaining long at the end of 2021 was quite simple. That’s what I said back at MarketVision 2022. I didn’t guarantee a cyclical bear market ahead, though I indicated it was certainly possible that we’d see one. Rather, I pointed out all the warning signs and then let the bearish price action confirm all of those warning signs.

What About the Nasdaq Composite?

The cyclical bear market gripped the Nasdaq Composite ($COMPQ) stocks even harder during 2022. When we began 2022, $COMPQ’s 22-month ROC was topped only by the dot-com bubble in 2000 (see chart below).

Can we look at these two charts and at least agree that the picture from the end of 2021 and now has changed? The above ROCs are telling us very different stories at the end of 2022. For only the seventh time since the late-1970s, $COMPQ’s 22-month ROC has reached a -15 to -20%. In the secular bull market cases in the 1980s, the market rebounded very quickly, generating substantial gains.

Now the question is “when is enough enough” in terms of the selling? Some might look at the $COMPQ chart and think it has a lot further to go lower, which is fine if that’s what you believe. I would, however, point out that the massive rally in 1999 and into 2000 occurred at the tail end of a 20-year secular bull market.

Let me show you the difference between 1999 and 2022 using a 240-month ROC (20 years equals 240 months):

Over the 20 years ended at the end of 1999, the 20-year ROC was 3400%, or approximately 17% per year. That’s 20 years of performance way above the average annual return on $COMPQ, which is roughly 11%. That type of extended outperformance is what triggers secular (long-term) bear markets. At the 20-year ROC peak in 2021, the market was at 850%. That equates to an average return of 4.25% over the past 20 years. That’s way below the average 11% annual return of $COMPQ. That’s one reason why I don’t buy into the secular bear market argument. While our 22-month ROC was extremely high, resulting in the 2022 cyclical bear market, the 20-year ROC is nowhere near the high it will reach in another 10 years. I believe we’ll see it reach 2500%–3000% in a decade.

It’s been a brutal 2022, but, if we were objective at the end of 2021, it was easy to see it coming. Now it’s time to pick up the pieces and objectively evaluate what’s likely to transpire in 2023. I have confidence and conviction that I’ll nail 2023 as I nailed market action in our three previous MarketVision events.

If you’d like to join me and several of the StockCharts.com team at MarketVision 2023, here’s the best news of all. It’s once again free to everyone and there is no credit card required. You simply have to register, because I can promise you that we will reach capacity. SAVE YOUR SEAT NOW! CLICK HERE for more information and to enter your name and email address. We’ll give everyone plenty to think about as you strategize in the new year!

Happy trading!

Tom